Microfinance has made a pretty major comeback after the whole 2010 fiasco where people bashed MFIs (microfinance institutions) for being ineffective at fighting poverty, money hungry, and, in the Indian state of Andhra Pradesh, responsible for farmer suicides. There was general public outcry at the idea of for-profit MFIs. Intuitively, it seemed to make sense that the only way to make a profit when dealing with the poor would be to pick the poor’s pockets. This really broke the Robin Hood perception that microfinance had built around itself. I learned all this from Challenges of Global Poverty – the same course I talked about in this blog post.

Recently, I saw that there was not only a resurrection of sorts for microfinance as an industry, but for the for-profit MFIs as well. Bandhan, Equitas, SKS, Janalakshmi, and Ujjivan – the five biggest MFIs in India based on loan portfolio size (according to the 2014-15 SKS annual report), are either public or have an IPO waiting in the wings.

I wanted to see exactly how for-profit microfinance institutions were making a killing. Did they change where they were based? Apart from a withdrawal from Andhra Pradesh, the state where the government made repaying MFI loans illegal, causing many of these institutions to nearly shut shop, there weren’t many changes. Had they changed their target customers? I can’t say. It didn’t look that way from their reports. The stories about women transforming their hobby of stitching into a full blown saree business were all there.

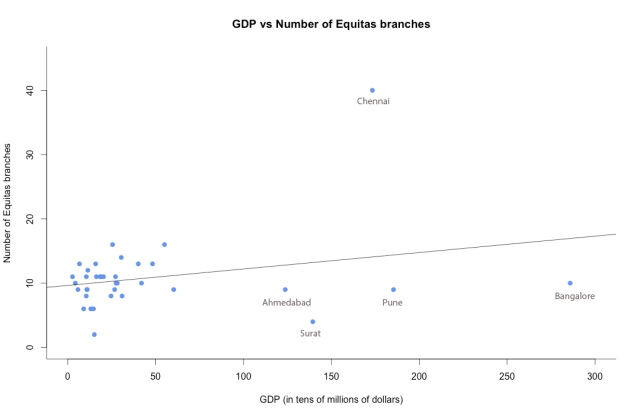

To answer this question, I’d have to see if for-profit MFIs were serving the poorest of the poor or whether they had moved on to slightly bigger fish. I decided to take a crack at it by comparing the GDP of a city against the number of Equitas Microfinance branches there were in that city. If they were looking to maximize profit, it’d seem like they would prefer larger, wealthier accounts (for a higher profit margin per account). And if they were moving to cities with a higher GDP, that could mean they were ‘abandoning’ the poor in pursuit of this bigger fish in bigger cities.

I found the branch data for Equitas on their website.

A quick fact about the graph: Chennai is such an anomaly because Equitas is based in Chennai.

I found a correlation coefficient of 0.73 when I regressed the number of Equitas branches on the GDP for each town. This is a pretty convincing correlation. So, yes, Equitas at least, was moving to cities. Still, does that mean it’s fair to start pointing fingers at MFIs and accuse them of ‘abandoning’ the poor? No, it’s likely that there could be a ton of other factors I overlooked.

First, moving to a city doesn’t make an MFI less sensitive to the poor. It could just mean that they cater to the urban poor – something that I haven’t taken into account. Second, this is specific to Equitas. Not all MFIs are distributed like this. Third, maybe a third factor, such a population, would explain both these variables.

To narrow my search, I’d have to test the branch location data of MFIs against the percentage of poor in each city, other MFI locations (to see if they open in the same cities) and population. This would make a little clearer if Equitas and other MFIs still operate for the poorest of the poor. I’ll do this in upcoming blog posts and hopefully come closer to an answer.