Hero MotoCorp, in their annual report state that they have a 40% market share in the domestic two wheeler market. I did not recall seeing all that many Hero showrooms in Hyderabad and wanted to find out where they sell the most bikes and have maximum presence.

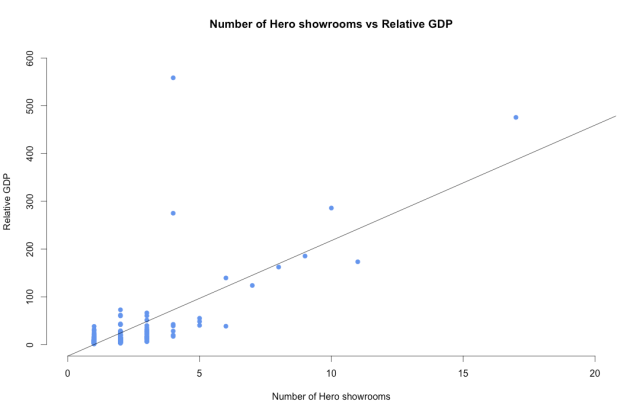

This is the graph plotting the number of Hero showrooms in Indian cities against the “Relative GDP”, or the GDP/10^8 for each city. This is the spreadsheet I made and sourced my data from.

The regression plot above has an R value of 0.52. This means that the change in the GDP of a town accounts for only 52% of the change in the number of Hero showrooms in that town.

This seems a little odd to me because intuitively, shouldn’t cities with a higher GDP – typically larger cities, have a lot more franchises than smaller towns? Domino’s (0.84) and CCD (0.80) showed higher R values.

This got me searching, and eventually I found that Hero has showrooms in small towns with populations barely over a hundred thousand. I learnt that Hero has 613 locations with showrooms while Domino’s has only 212 in comparison. A smaller town can support a Hero showroom but not a Domino’s restaurant. This means that Hero has a target audience in small towns too. This could also possibly mean that the consumption of bikes in smaller towns is comparable to that of cities.

There’s also a pattern where Hero showrooms tend to increase incrementally as GDP increases while the number of Domino’s restaurants seems to grow exponentially. The city with the most number of Hero showrooms is Delhi at 17 but there’s 76 Domino’s restaurants in Delhi.

I’ll keep this page updated and try and find out more about how Hero places their showrooms.